Ministry of Communications

(Department of Posts, Directorate of Postal Life Insurance)

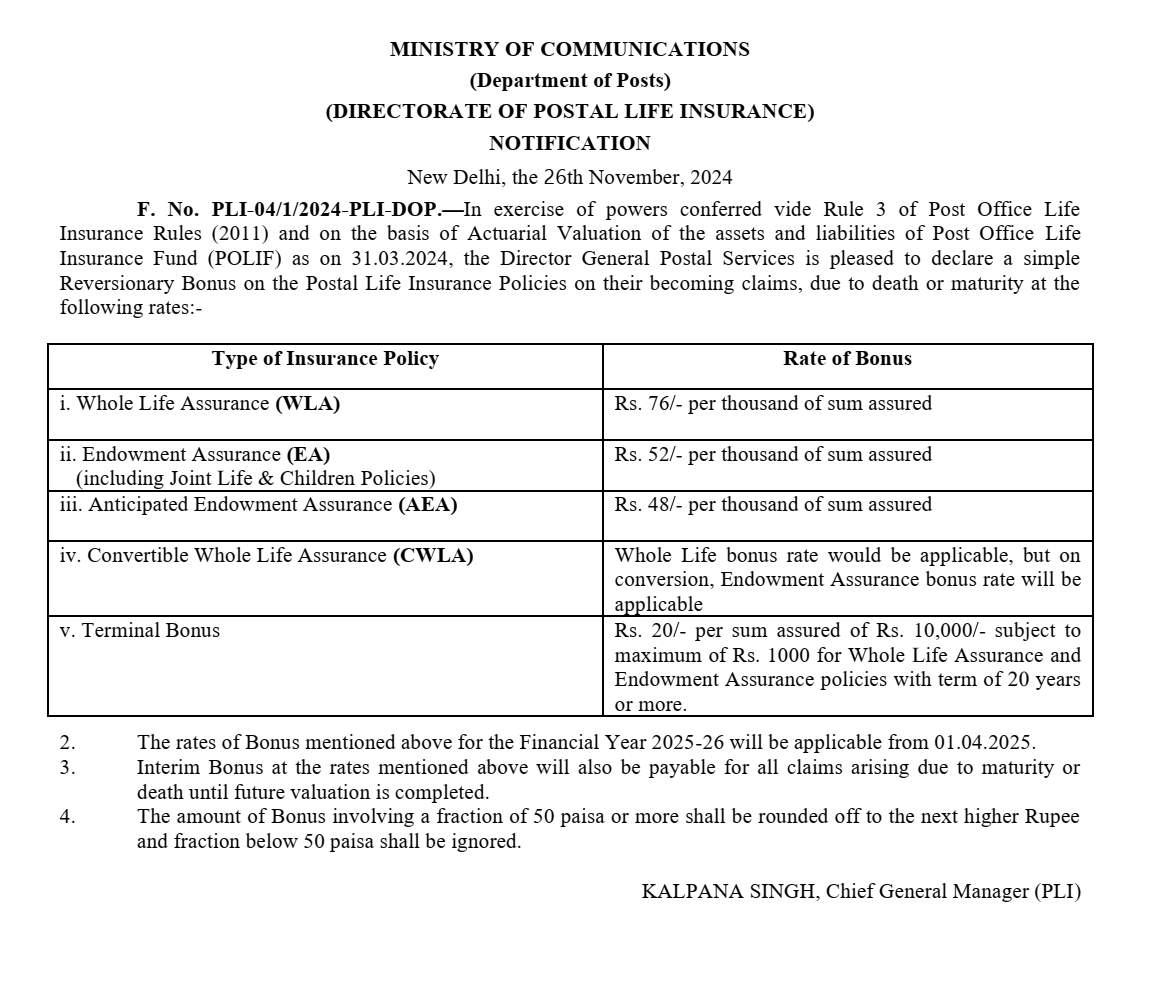

Notification No.: PLI-04/1/2024-PLI-DOP | Date: 26th November 2024

Declared Bonus Rates for 2025-26 (Effective 01.04.2025)

| Policy Type | Bonus Rate (per ₹1,000 sum assured) |

|---|---|

| Whole Life Assurance (WLA) | ₹76 |

| Endowment Assurance (EA) | ₹52 (Includes Joint Life & Children Policies) |

| Anticipated Endowment Assurance (AEA) | ₹48 |

| Convertible WLA (CWLA) | WLA rates apply; switches to EA rates upon conversion |

| Terminal Bonus | ₹20 per ₹10,000 sum assured (max ₹1,000; for policies ≥20 years) |

Key Directives:

- Applicability: Rates effective from 1st April 2025 for FY 2025-26.

- Interim Bonus: Payable for death/maturity claims until final valuation.

- Rounding Off: Fractions ≥50 paise rounded up; <50 paise ignored.

Signed by:

Kalpana Singh

Chief General Manager (PLI), Directorate of Postal Life Insurance

Postal Life Insurance (PLI) Bonus Rates 2025-26: Key Highlights

Keywords:PLI Bonus Rates 2025-26, Postal Life Insurance Notification, India Post Bonus Declaration, PLI Policy Benefits, Endowment Assurance Bonus, Whole Life Insurance, Terminal Bonus, Government Insurance Schemes, Ministry of Communications

1. Overview

The Directorate of Postal Life Insurance (PLI) has announced revised bonus rates for FY 2025-26 via Gazette Notification (26th November 2024). These rates apply to policies maturing or becoming death claims from 1st April 2025.

Endowment Assurance (EA): ₹52/₹1,000 (covers joint life/children policies).

Terminal Bonus: One-time payout of ₹20/₹10,000 (max ₹1,000) for policies ≥20 years.

Fiscal Prudence: Rates based on actuarial valuation of PLI Fund (POLIF) as of 31st March 2024.

Transparency: Rounding rules prevent fractional losses.

Stability: Government-backed assurance with declared benefits.

New Subscribers: Compare policies (e.g., WLA vs. EA) for optimal returns.

Official Reference:

Gazette No.: 325 (Extraordinary Part I-Section 1)

F.No.: PLI-04/1/2024-PLI-DOP

2. Policy-wise Bonus Breakdown

Whole Life Assurance (WLA): Highest bonus at ₹76/₹1,000 sum assured.Endowment Assurance (EA): ₹52/₹1,000 (covers joint life/children policies).

Terminal Bonus: One-time payout of ₹20/₹10,000 (max ₹1,000) for policies ≥20 years.

3. Critical Updates

Interim Bonus: Ensures claimants receive payouts at new rates during valuation gaps.Fiscal Prudence: Rates based on actuarial valuation of PLI Fund (POLIF) as of 31st March 2024.

4. Why This Matters for Policyholders

Higher Returns: WLA policies offer 46% higher bonuses vs. EA.Transparency: Rounding rules prevent fractional losses.

Stability: Government-backed assurance with declared benefits.

5. Action Points

Existing Policyholders: Verify bonus accruals via India Post Portal.New Subscribers: Compare policies (e.g., WLA vs. EA) for optimal returns.

Official Reference:

Gazette No.: 325 (Extraordinary Part I-Section 1)

F.No.: PLI-04/1/2024-PLI-DOP

Updates:

Follow us on WhatsApp, Telegram Channel, Twitter and Facebook for all latest updates

Post a Comment