IPPB & POSA Account Linkage in Micro ATM

Most of the screens remain the same as earlier, but there are few changes in some of the screens in the POSA Linkage process through mATM. Revised POSA Linkage flow is as below,

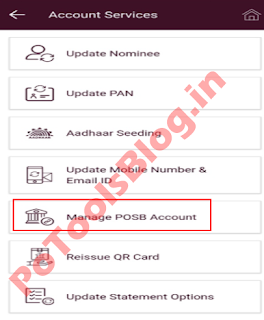

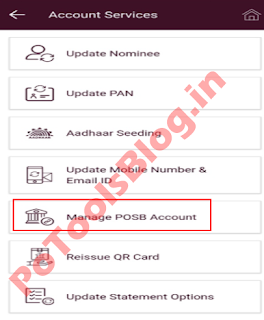

1. Go to the Manage POSB Account option under the Account services module

2. All available accounts for the customer will be displayed. Choose the SB account of the customer to proceed with POSA Linkage. Current accounts cannot be linked with POSA accounts.

3. This screen has undergone few changes. The name fetched from the POSA system and IPPB account name shall be displayed.

4. Customer Name – The name of the IPPB account holder will be fetched and displayed here

5. POSA Customer name- The name of the POSA account holder will be fetched and displayed here.

6. The existing practice of ensuring that both IPPB Account holder and POSA account holder are the same person by checking POSA passbook and ID details shall continue.

7. To aid and assist End-users perform the cross-checking better, both names from the IPPB account and POSA account will be displayed on the same screen.

8. There have been small changes in consent in this screen. A new consent related to name matching of displayed names is included. End-user must accept both consents.

9. The last two consents are to be obtained from the Customers. End users shall explicitly convey the same to the customers and obtain their consent.

10. All four consents must be agreed to proceed forward.

11. After having agreed to the consent, a screen containing the IPPB SB Account number and present balance in the account along with the POSA Account number will be displayed.

12. Charges, if applicable, will also be displayed. End-user can check if the IPPB account has sufficient balance to cover the charges or not and proceed accordingly by tapping the Confirm button

13. Customer Authentication will be required which can be performed using any of the permitted options.

14. Once the customer Authentication is completed, the final status of the POSA Linkage request will be displayed as “Success”, “Failure” or “Under processing

15. Failure in linkage can happen due tomultiple reasons. Two of the mostprominent reasons are,

a) If the POSA Account is not eligible forlinkage as it does not fulfill requisiteconditions laid down for the same. i.e thePOSA account is a Joint account, notseeded with Aadhar, not KYC compliant,not having ten digits mobile number orany other such condition.

b) If the POSA account is already in linkedstatus.

16. If a previous linkage request is pending with CPC and another attempt for linkage is initiated. Appropriate error messages will be displayed accordingly.

17. If the POSA account selected is eligible for linkage and other requisite details are in order, the linkage will be successful and the message displayed accordingly.

18. Other than Success and Failure, status can also be as “Under Process”. This status simply means the request for linkage is submitted but not successful or failed. Only after CPC processes the request, the final status will be known.

19. Customers must be conveyed to wait up to 3 days and check the SMS received in this regard.

20. Records that are auto-selected for random cross-check at CPC and/or Timed out POSA linkage requests may have this status.

21. It may take up to 3 working days (maximum limit) to get the record processed at CPC and the final status may change to Success or Failure

22. It shall be noted that an IPPB account having its linkage request under process, any new linkage request will not be allowed and if initiated, such requests will result in failure, as illustrated above in point 16.

23. Customers will be kept duly informed, vide SMS, about the final status of the POSA linkage request.

Updates:

Follow us on WhatsApp, Telegram Channel, Twitter and Facebook for all latest updates

Post a Comment