New Tax Regime as Default for A.Y. 2024-25. User can check whether which regime is beneficial for government employees using the following calculator.

Income Tax New and Old Regime Calculator

Overview

The Income and Tax Calculator service enables both registered and unregistered e-Filing users to calculate tax as per the provisions of Income Tax Act, Income-tax rules, Notifications etc. by providing inputs with respect to income(s) earned and deductions claimed as per the Act. This service also provides a calculation of tax under the old or new tax regime with a comparison of tax as per the old and new regime.

Prerequisites to Avail This Service

• Access to the e-Filing portal

Step-by-Step Guide

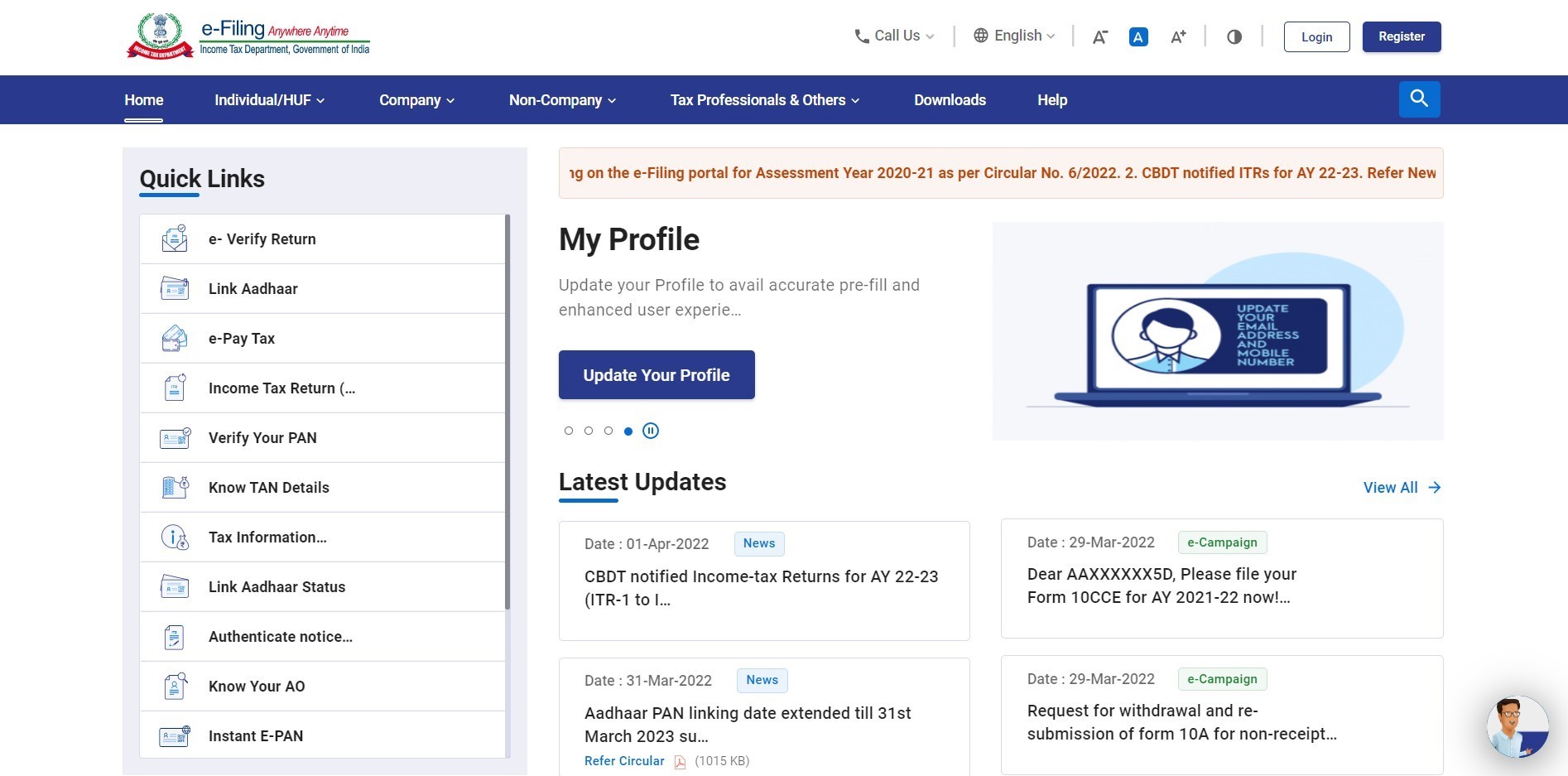

Step 1: Go to the e-Filing portal homepage.

Step 2: Select Quick Links > Income and Tax Calculator. (Select the quick link in the image to show where is the calculator) (No access to UAT/SIT currently, will have to add it later)

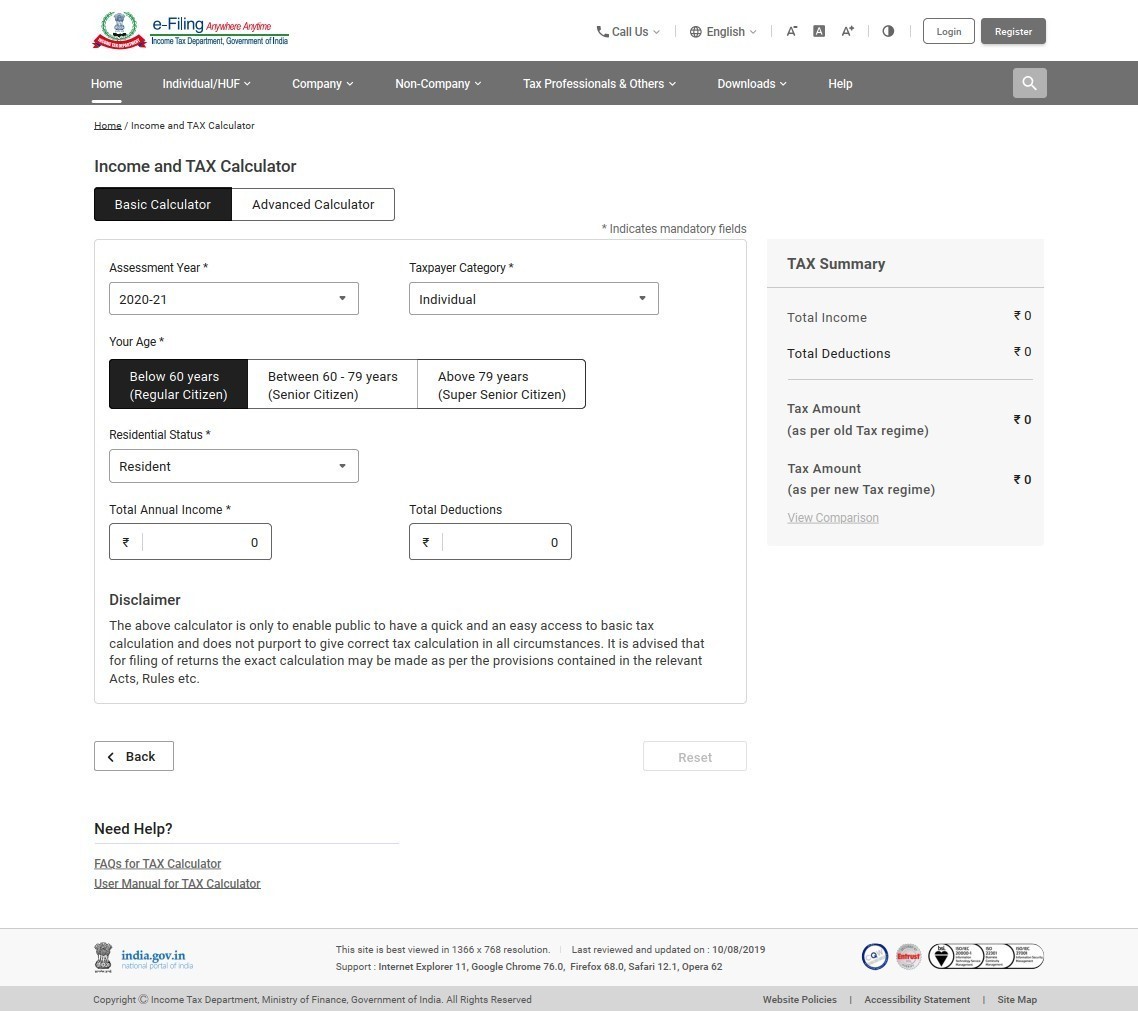

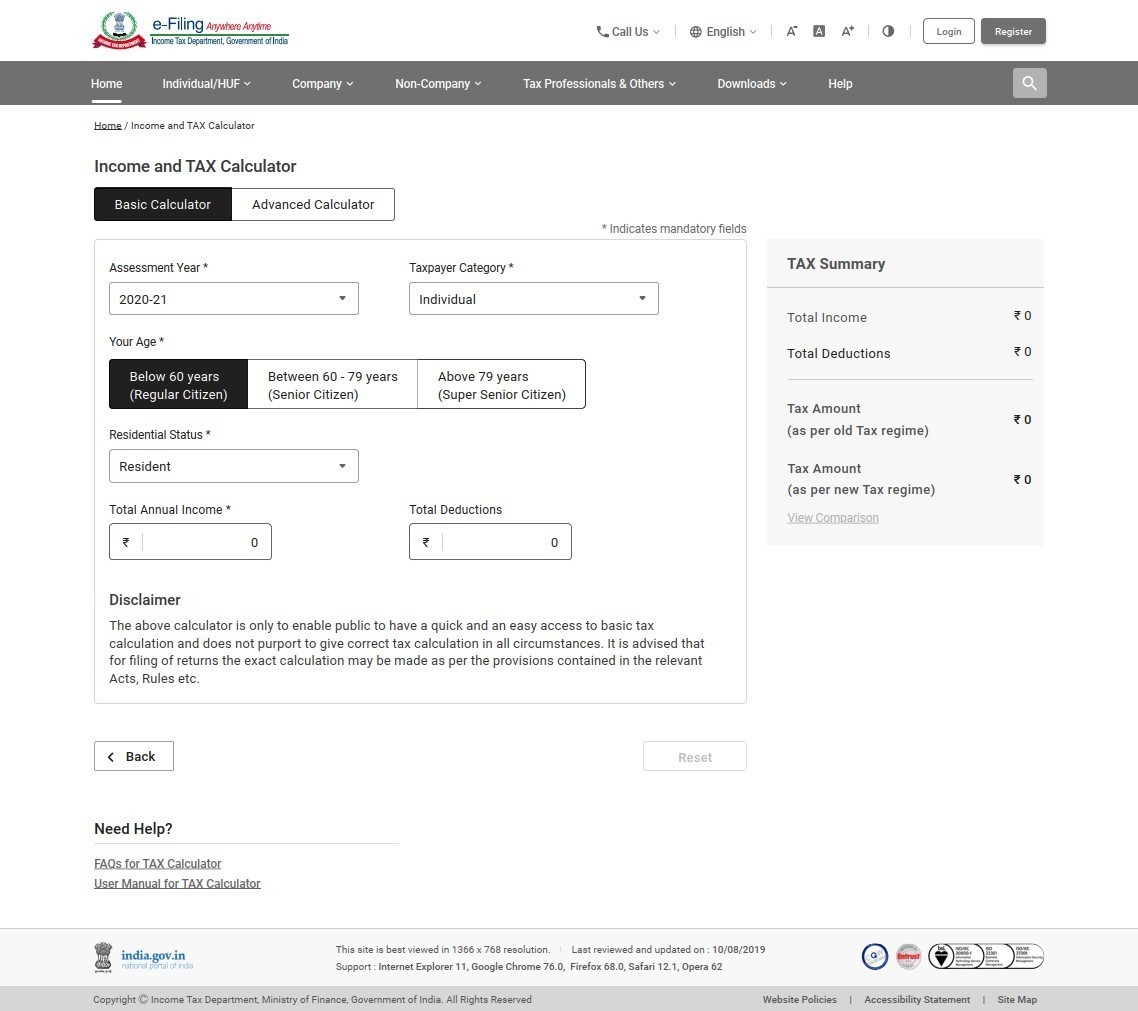

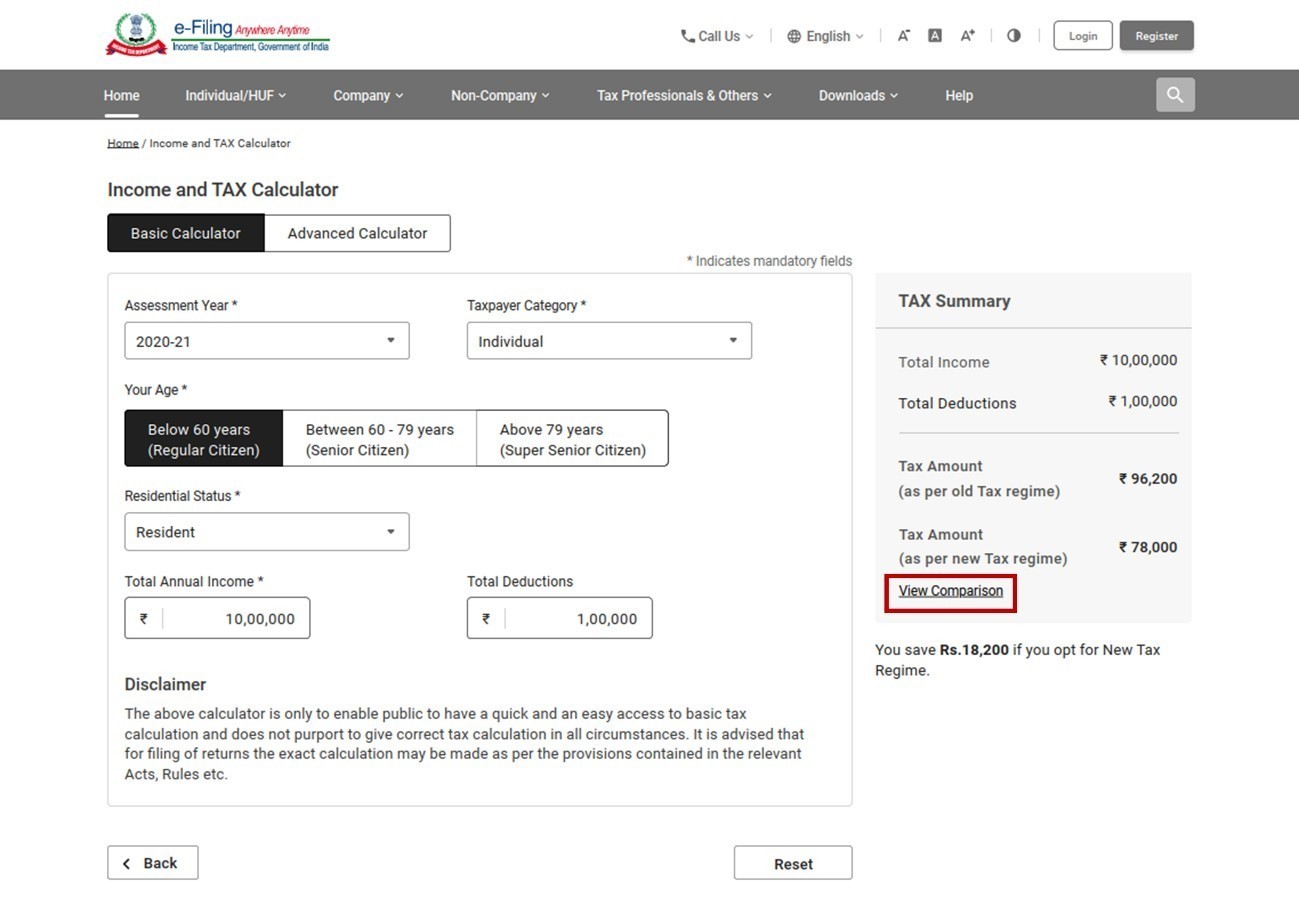

You will be taken to the Income and Tax Calculator page. There are two tabs – Basic Calculator and Advanced Calculator. The Basic Calculator tab is selected by default.

Step 3a: In the Basic Calculator tab, enter the required details such as AY, taxpayer category, age, residential status, total annual income and total deductions. The tax calculation as per the details entered by you will appear in the Tax Summary section.

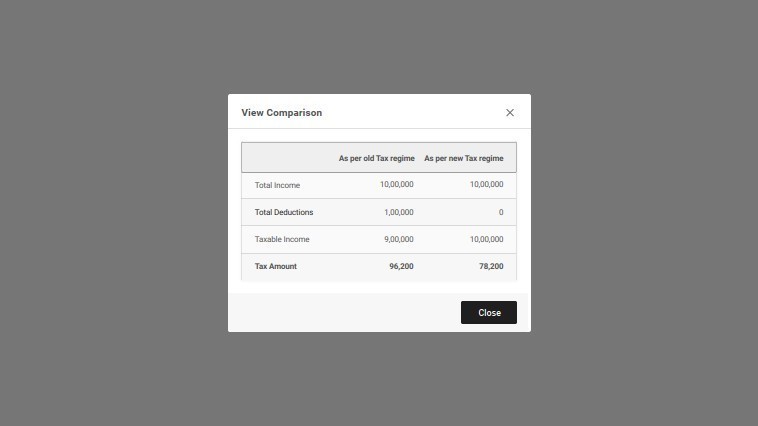

Note: Click View Comparison to get a more detailed comparison of tax under the old and new tax regime.

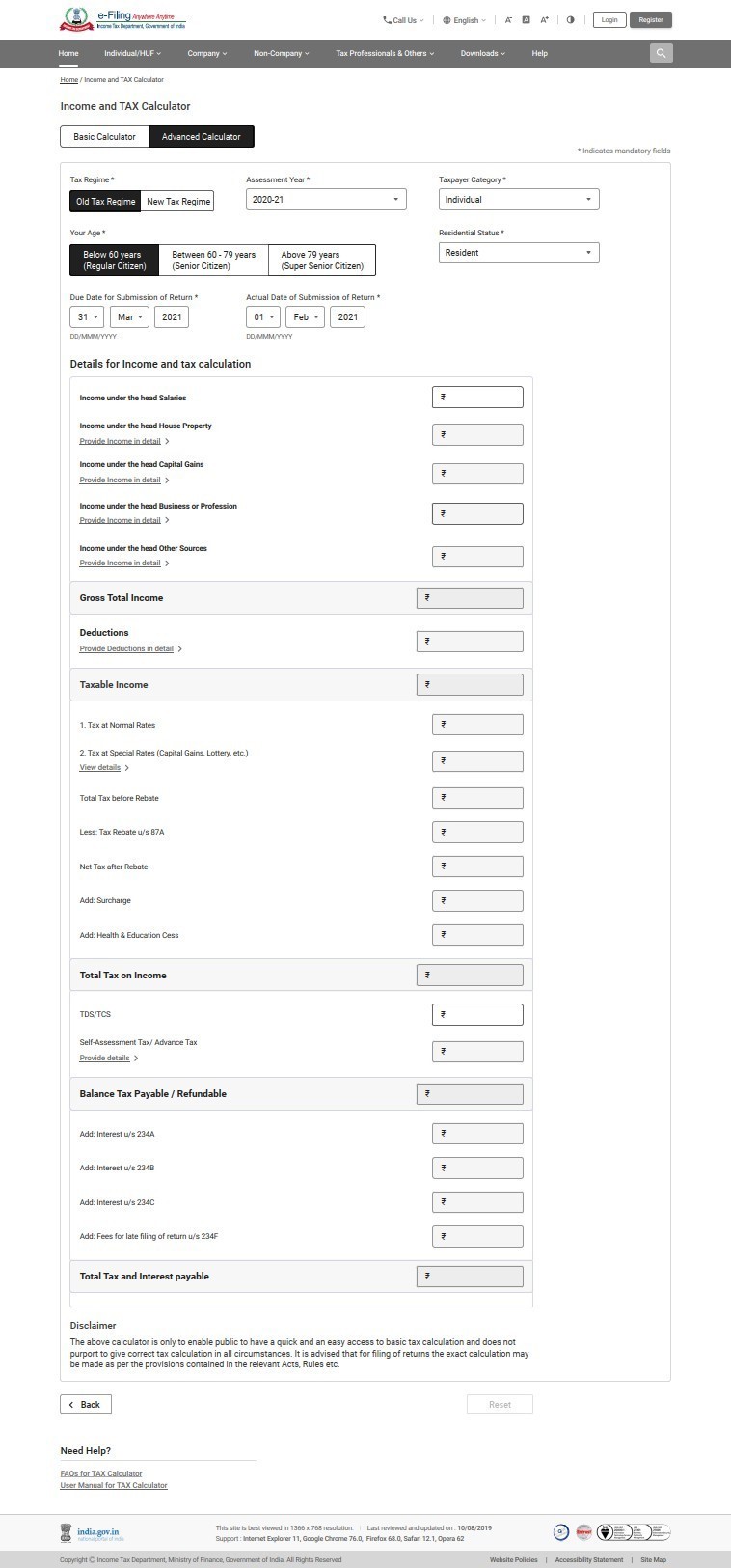

Step 3b: In the Advanced Calculator tab, enter the following details:

Preferred tax regime, AY, taxpayer category, age, residential status, due date and actual date of submission of return.Under Details for Income and tax calculation, enter the required details of:

Income under the head Salaries,

Income under the head House Property,

Income under the head Capital Gains,

Income under the head Business or Profession, and

Income under the head Other Sources. (what details are required?) – (entered)

Under Deduction Details, enter the relevant deductions applicable to you, including but not limited to PPF, LIC, Housing Loan, NPS, Mediclaim, Loan on Higher Education. (what details are required?) – (entered)

Under Taxable Income, enter or edit the TDS/TCS details where you have substantiating evidence available.

The total tax and interest payable by you will be displayed at the end of the page.

Income Tax Calculator - FAQs

1. How is the income and tax calculator service beneficial to registered e-Filing users?

The income and tax calculator service enables registered and unregistered e-Filing users to perform the following actions:

- Access their tax calculation with basic and/or advanced calculator in a quick and easy manner without logging into the e-Filing portal.

- Compare their tax as per the old tax regime and new tax regime introduced in the Finance Budget 2020.

2. How is the current income and tax calculator service different from the previous version on the old e-Filing portal?

The Income and Tax Calculator service is now a Quick link on the e-Filing portal.

You can estimate tax as per new tax regime and old tax regime and compare the results.

3. Can I consider the calculation from the income and tax calculator exact, and use it when filing my return?

No. The income and tax calculator enables you to have a quick view of your basic tax calculation and does not necessarily give your final tax calculation in all circumstances. For filing of returns, the exact calculation may be made as per the provisions contained in the relevant Acts and Rules.

Updates:

Follow us on WhatsApp, Telegram Channel, Twitter and Facebook for all latest updates

Post a Comment